For years, if you wanted to buy or sell a house in Dallas, Zillow was the first place you opened. The site has massive reach, pulls in nearly every listing, and gives you an instant home value estimate with just a click. In many ways, it set the rules for how real estate gets done in Dallas.

But anyone who’s spent time on the platform knows it isn’t perfect. Home values can feel off, the leads agents receive don’t always pan out, and sellers question whether a national site really understands the street-level details that matter in Dallas. The scale is impressive, but the personal connection is missing, and people here are starting to notice.

That gap is sparking new questions. What if a different app came along that actually knew the Dallas market block by block, built more trust with buyers, and delivered stronger results for sellers? If that happened, Dallas could be the first place where Zillow finally meets real competition.

It won’t flip overnight, but you can already hear the talk picking up.

Why Zillow Leads in Dallas

In Dallas, Zillow has become shorthand for house hunting. When buyers start looking, the first instinct is to scroll through the app before calling an agent. Sellers see it as the quickest way to put eyes on their property, and agents know that being off Zillow means missing out. It’s worked its way into the local process so deeply that most people don’t even think twice about it.

The features have a lot to do with that. The Zestimate gives buyers a ballpark number, even if it’s not exact. The coverage stretches across nearly every neighborhood, and the brand is so well-known that it feels like the natural first step. In a fast-growing city like Dallas, convenience counts, and Zillow has delivered that consistently.

All of this—visibility, data, and habit—has made Zillow the default marketplace. But Dallas is a market that changes quickly, and even the most trusted platforms can lose ground when people start looking for something better.

The Cracks in Zillow’s Model

Even with its reach, Zillow has weak spots that stand out in Dallas. The best-known example is the Zestimate. Many buyers treat the number as gospel, but agents in the city will tell you it can swing tens of thousands of dollars in either direction.

Another challenge is scale. Zillow was built for the whole country, not for one city with dozens of distinct neighborhoods. A historic Craftsman in Munger Place doesn’t belong in the same category as a new-build in Frisco, yet the platform tends to flatten those differences. Buyers lose the context they need, and sellers struggle to highlight what makes their home stand out in its own corner of Dallas.

Agents feel it too. Zillow does generate plenty of leads, but many of them never turn into real clients. Realtors often spend hours chasing names that lead nowhere, time that could have been spent serving real buyers and sellers.

These gaps don’t erase Zillow’s presence in Dallas, but they do leave room for something more local, more accurate, and more efficient to take hold.

Enter the Challenger App

A new group of platforms is starting to emerge in Dallas, designed with a different approach than Zillow. Instead of focusing only on national scale, these apps emphasize sharper pricing tools, neighborhood-level insight, and features that fit the way people in Dallas actually shop for homes. What a young professional wants in Oak Lawn looks very different from what a family needs in Plano. One-size-fits-all models rarely capture that.

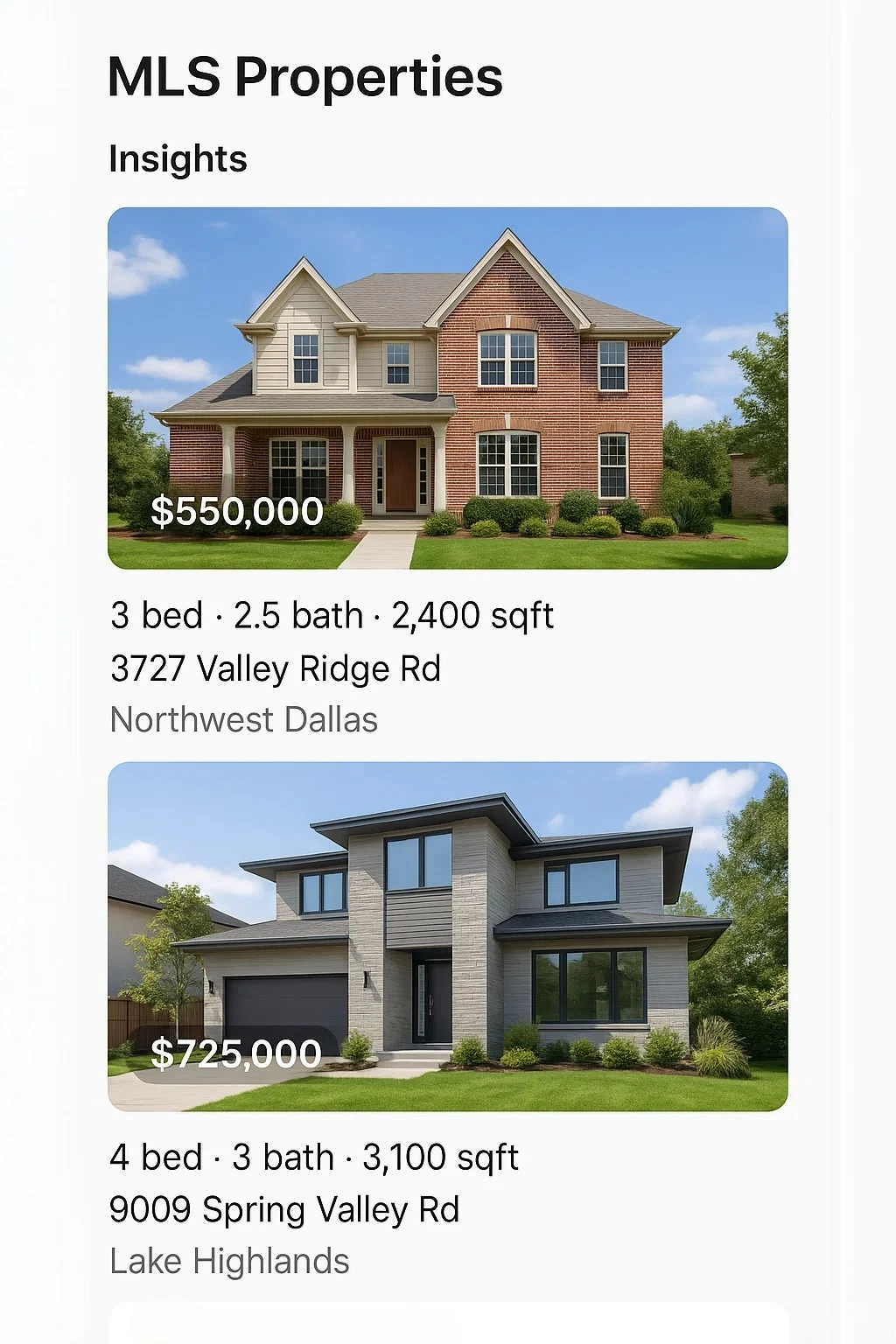

The new wave of apps uses sharper valuation methods, integrates data from local MLS sources, and offers cleaner, more intuitive design. That means buyers can compare homes with more useful context, and agents have a better shot at connecting with serious clients instead of casual browsers.

Such innovation reflects the growing role of a real estate app development company working directly with Dallas professionals to create tools that feel native to the city. The focus is not on replacing Zillow overnight but on building platforms that reflect the unique character of Dallas neighborhoods and provide more reliable support to buyers, sellers, and agents.

How It Outshines Zillow

When you put a Dallas app side by side with Zillow, the differences show up fast. Zillow gives you reach, but accuracy often slips. A lot of buyers see the Zestimate and think it’s set in stone, but agents know it can miss the mark by quite a bit. Local apps lean on MLS data and add context from the neighborhoods themselves, so the numbers line up better with what homes are really selling for. That keeps buyers from chasing inflated prices and helps agents argue their case with facts that hold up at the table.

The layout is another place where things split. Zillow can feel busy, such as ads, pop-ups, and extra prompts everywhere. The newer Dallas apps keep it simple. You scroll, you look at the house, and that’s it. Agents also get more space to show off a property without fighting for attention.

Zillow isn’t going away. It would be misleading to suggest that an app like Zillow has no strengths, but its broad focus creates limitations that local competitors are eager to improve upon. And in a city like Dallas, that wide lens often misses the details that matter. Smaller, focused platforms can be quicker, clearer, and easier to trust.

The Dallas Factor

Dallas has become one of the hottest housing markets in the U.S., and that makes it the perfect testing ground for new real estate tech. People are moving in fast, demand keeps climbing, and the choices are broad—starter homes in East Dallas, bigger lots in the suburbs, new developments in Frisco. One app can’t treat those the same way and expect buyers to be satisfied.

Prices, schools, and even the feel of a block can swing wildly from one part of the city to the next. An app that knows the difference between Oak Cliff and Highland Park or between a historic home and a new build, will always beat a one-size-fits-all search tool.

Realtors here are also willing to try new options. They want leads that don’t waste their time, and they’re open to platforms that give them more control. That openness is one reason Dallas could be the first place where a serious Zillow competitor really takes off.

Global Perspective

Other cities are seeing the same shift toward local platforms, each shaped by its own market. In London, rental apps dominate. In Singapore, the push is for more transparency in deals. Toronto leans on tools for a diverse buyer base.

In Dubai, where international investors are a big part of the market, it’s common to see a mobile app development company in Dubai step in with tools that make it easy to browse and buy from anywhere.

Sydney, Berlin, and other cities show the same pattern: the tech adapts to what the local market demands. Sometimes that’s regulation, sometimes it’s rapid growth, sometimes it’s investor pressure. Dallas is now in that mix. The city has the chance to build its own version, tools that actually match its neighborhoods and the way people here buy and sell.

What This Means for Realtors and Buyers

For Dallas agents, the new wave of apps feels like a chance to get back to what matters. Instead of chasing dozens of names that never turn into clients, they can work with platforms built to deliver quality leads. That means more time sitting down with real buyers and sellers, and less time sorting through forms that go nowhere.

Buyers get the benefit of clarity. When home values are pulled from MLS data and backed up by what’s actually selling in Oak Cliff, Plano, or Frisco, you can make decisions with more confidence. You’re not stuck guessing whether a Zestimate is off by $40,000. Instead, you can focus on what really matters, like commute times on I-635, the schools in Richardson, or how a home in East Dallas might hold its value.

Sellers gain from the same shift. When buyers walk in better informed and agents have stronger tools, homes get priced in line with the market and shown with context that highlights their real worth. Negotiations move faster, and fewer deals stall over mismatched expectations.

It won’t flip the Dallas market overnight, but these changes point toward a future where tech fits the city instead of forcing the city into a one-size-fits-all box.

What’s Next?

Zillow isn’t disappearing tomorrow. Everyone knows the name, and plenty of buyers will still open the app when they start their search. But Dallas is different right now. The city is growing fast more than 150,000 people moved into the metro area in just the last couple of years and buyers are demanding tools that reflect that pace.

What’s likely to happen is a slow handoff. Realtors will keep Zillow on the table, but they’ll start sliding local apps in front of clients who want something sharper. Buyers will try them out because they’re tired of generic numbers that don’t match what they hear from their agent. If those apps keep delivering results such as cleaner valuations, better listings, and stronger leads, then trust will build naturally.

The tools themselves are also catching up. MLS-backed pricing, maps that break down neighborhoods street by street, even filters that show things like walkability or commute times, these are features being tested in other markets, and they’re not far from Dallas.

Real estate here won’t flip overnight. But if you look at the way buyers, sellers, and agents are moving, you can already see the ground shifting.